Beginning with the importance of a fiduciary financial advisor, this article delves into the critical role they play in managing investments and why their services are crucial in today's financial landscape.

The following sections will cover qualifications, fee structures, tailored financial planning, and more, providing a holistic view of the benefits of working with a fiduciary advisor.

Importance of a Fiduciary Financial Advisor

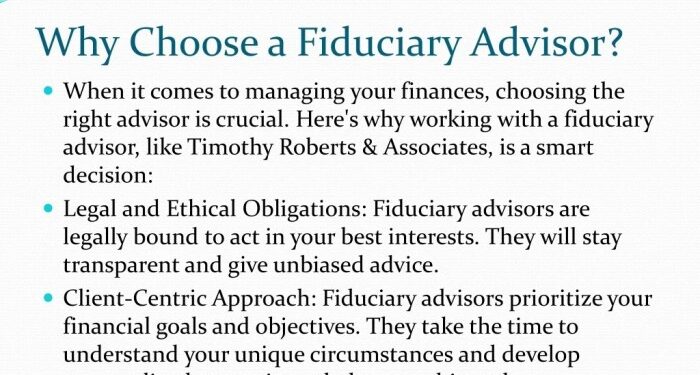

Fiduciary financial advisors play a crucial role in managing investments by putting the client's best interests above all else. Unlike non-fiduciary advisors who may have conflicts of interest, fiduciaries are legally obligated to act in a way that benefits their clients.

Benefits of Working with a Fiduciary Advisor

- Fiduciary advisors provide unbiased advice and recommendations since they are not influenced by commissions or incentives from financial products.

- They are transparent about fees and costs, ensuring that clients understand the expenses associated with their investments.

- Fiduciaries offer personalized financial strategies tailored to the individual goals and needs of each client.

How Fiduciary Advisors Prioritize Client’s Best Interests

Fiduciary advisors prioritize the client's best interests by:

- Conducting thorough assessments of the client's financial situation and goals before making any recommendations.

- Regularly reviewing and adjusting investment portfolios to align with the client's changing circumstances.

- Providing ongoing education and support to help clients make informed decisions about their finances.

Qualifications and Credentials

When it comes to fiduciary financial advisors, having the right qualifications and certifications is crucial to ensure they have the expertise and knowledge to handle your financial matters effectively.

Typical Qualifications and Certifications

- CFP (Certified Financial Planner): This certification is one of the most recognized and respected in the financial industry. It demonstrates that the advisor has completed extensive training and passed a rigorous exam covering various financial planning topics.

- CFA (Chartered Financial Analyst): A CFA designation signifies a high level of expertise in investment management and financial analysis. Advisors with this certification have undergone a demanding program that covers a wide range of investment topics.

Importance of Certifications

Having certifications like CFP or CFA sets fiduciary advisors apart by demonstrating their commitment to professionalism and ethical standards. These credentials provide clients with assurance that their advisor has the necessary skills and knowledge to provide sound financial advice.

Fee Structures and Transparency

When it comes to financial advisors, understanding fee structures and transparency is crucial in making informed decisions about your investments. Let's delve into the differences between fiduciary and non-fiduciary advisors in this aspect.

Fee Structures Comparison

One of the key distinctions between fiduciary and non-fiduciary advisors is how they charge for their services. Fiduciary advisors typically charge a fee based on a percentage of the assets they manage or a flat fee for their services. This fee structure aligns their interests with yours, as they do not earn commissions or incentives for recommending certain products or investments.

On the other hand, non-fiduciary advisors may earn commissions from financial products they sell to clients, leading to potential conflicts of interest. They may not always act in your best interest, as their recommendations could be influenced by the commissions they stand to gain.

Transparency in Fee Disclosure

Fiduciary advisors are held to a higher standard when it comes to fee transparency. They are required to disclose all fees upfront, including how they are compensated and any potential conflicts of interest that may arise. This transparency allows you to understand the cost of their services and the motivation behind their recommendations

Non-fiduciary advisors may not always provide clear information about their fees or how they are compensated, making it difficult for clients to fully grasp the financial implications of working with them. This lack of transparency can lead to misunderstandings and erode trust between the advisor and the client.

Importance of Understanding Fee Structures

Choosing a financial advisor is a significant decision that can impact your financial future. Understanding fee structures is essential in ensuring that you are getting value for the services provided and that your advisor is acting in your best interest.

By opting for a fiduciary advisor with transparent fee disclosure, you can have peace of mind knowing that your financial well-being is their top priority.

Tailored Financial Planning

Tailored financial planning is a crucial aspect of fiduciary advisors' services, as it involves creating personalized financial plans that cater to the unique needs and goals of each client. By thoroughly evaluating a client's financial situation and objectives, fiduciary advisors can develop a customized plan that aligns with their specific circumstances.

Personalized Evaluation Process

Fiduciary advisors start by conducting a comprehensive assessment of a client's financial status, including assets, liabilities, income, expenses, and future financial goals. This evaluation helps them gain a deep understanding of the client's current situation and what they hope to achieve in the future.

- By analyzing the client's risk tolerance, time horizon, and investment preferences, fiduciary advisors can tailor an investment strategy that suits their individual needs.

- They consider factors such as retirement planning, education funding, estate planning, tax implications, and insurance needs to create a holistic financial plan.

- Throughout the process, fiduciary advisors maintain open communication with their clients to ensure that the plan remains aligned with their changing circumstances and objectives.

Adapting to Changes

Fiduciary advisors understand that life is dynamic, and market conditions can fluctuate. Therefore, they continuously monitor their clients' financial plans and make adjustments as needed to accommodate any changes in their lives or the economic environment.

Fiduciary advisors may modify investment allocations, retirement savings strategies, or risk management techniques based on shifts in a client's personal situation or market conditions.

- For example, if a client experiences a significant life event such as marriage, divorce, birth of a child, or job loss, the fiduciary advisor will update the financial plan accordingly to reflect these changes.

- In times of market volatility or economic uncertainty, fiduciary advisors may recommend adjustments to the investment portfolio to mitigate risks and capitalize on opportunities.

Final Conclusion

In conclusion, the necessity of having a fiduciary financial advisor in today's complex financial world cannot be overstated. Their expertise, transparency, and tailored approach make them indispensable partners in securing your financial future.

Questions Often Asked

What are the typical qualifications of a fiduciary financial advisor?

A fiduciary financial advisor typically holds certifications like CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst) to demonstrate their expertise and commitment to ethical standards.

How do fiduciary advisors prioritize the client's best interests?

Fiduciary advisors are legally bound to prioritize their client's best interests above all else, ensuring that their recommendations are solely aimed at benefiting the client.

What fee structures do fiduciary advisors usually have?

Fiduciary advisors often have fee-only structures, where they charge a transparent fee for their services without earning commissions from financial products they recommend.

How do fiduciary advisors create personalized financial plans?

Fiduciary advisors analyze a client's financial situation, goals, and risk tolerance to create tailored financial plans that evolve with changes in the client's life or market conditions.