Delving into the world of JP Morgan Financial Advisor Review: What Clients Need to Know, this introductory segment aims to provide a captivating glimpse into the realm of financial advisory services offered by the renowned institution.

Detailing the essential aspects of JP Morgan's financial advisory services, this paragraph sets the stage for a comprehensive exploration of what clients should be aware of.

Introduction to JP Morgan Financial Advisor

JP Morgan financial advisors play a crucial role in helping individuals and organizations manage their finances, investments, and financial goals. They provide personalized guidance and expertise to clients looking to build wealth, plan for retirement, or navigate complex financial decisions.

Services Offered by JP Morgan’s Financial Advisors

- Financial Planning: JP Morgan financial advisors offer comprehensive financial planning services to help clients set and achieve their financial goals.

- Investment Management: Advisors help clients create investment portfolios tailored to their risk tolerance, time horizon, and financial objectives.

- Estate Planning: Advisors assist clients in structuring their estates and creating plans for the transfer of assets to heirs.

- Risk Management: Advisors help clients assess and mitigate financial risks through insurance and other risk management strategies.

Importance of Choosing the Right Financial Advisor

Choosing the right financial advisor is crucial for achieving financial success and security. A knowledgeable and trustworthy advisor can provide valuable insights, help optimize financial strategies, and navigate market fluctuations effectively. On the other hand, a poor advisor may lead to costly mistakes, missed opportunities, and financial setbacks.

Therefore, it is essential to carefully evaluate and select a financial advisor who aligns with your financial goals, values, and communication style.

Qualifications and Expertise

When it comes to qualifications and expertise, JP Morgan financial advisors are among the top in the industry. They undergo rigorous training and have to meet specific requirements to provide the best financial advice to their clients.

Qualifications and Certifications

JP Morgan financial advisors are typically required to have a bachelor's degree in finance, economics, or a related field. In addition, they must obtain certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) to demonstrate their expertise and commitment to the profession.

These certifications require passing exams and meeting experience requirements, ensuring that JP Morgan financial advisors are well-equipped to handle complex financial situations.

Expertise Areas

JP Morgan financial advisors specialize in a wide range of expertise areas, including retirement planning, investment management, estate planning, tax strategies, and more. They work closely with clients to understand their financial goals and create personalized strategies to help them achieve success.

With access to the latest tools and resources, JP Morgan financial advisors are able to provide comprehensive and tailored financial advice to meet the unique needs of each client.

Comparison with Other Financial Institutions

Compared to other financial institutions, JP Morgan financial advisors stand out for their extensive qualifications and expertise. While other advisors may have similar certifications, JP Morgan's rigorous training programs and access to cutting-edge technology give their advisors a competitive edge in the industry.

Clients can trust that JP Morgan financial advisors have the knowledge and skills necessary to guide them through even the most complex financial situations.

Client Experience and Reviews

When working with a JP Morgan financial advisor, clients can expect a personalized and comprehensive approach to managing their finances. From the initial consultation to ongoing support, JP Morgan advisors strive to understand each client's unique financial goals and create a tailored plan to help them achieve success.

Typical Client Experience

- Initial Consultation: During the first meeting, the advisor will gather information about the client's financial situation, goals, and risk tolerance.

- Financial Plan Development: Based on the client's needs and objectives, the advisor will create a customized financial plan that may include investment strategies, retirement planning, and estate planning.

- Ongoing Support: JP Morgan advisors provide continuous monitoring of the client's portfolio and offer regular reviews to ensure the financial plan remains aligned with the client's goals.

Client Reviews and Feedback

- Many clients praise JP Morgan financial advisors for their professionalism, expertise, and commitment to helping clients achieve their financial goals.

- Clients appreciate the personalized approach and the high level of service provided by JP Morgan advisors.

- Some reviews highlight the excellent communication and responsiveness of JP Morgan advisors, making the client experience smooth and efficient.

Investment Strategies and Planning

When it comes to investment strategies and financial planning, JP Morgan offers a comprehensive range of services to help clients reach their financial goals. Their experienced financial advisors work closely with clients to develop personalized strategies tailored to their unique needs and risk tolerance.

Investment Strategies

- JP Morgan financial advisors commonly recommend a diversified investment approach, spreading investments across various asset classes to minimize risk.

- They may suggest a mix of stocks, bonds, mutual funds, and other investment vehicles to achieve long-term growth and stability.

- JP Morgan also offers access to alternative investments such as real estate, private equity, and hedge funds for qualified clients looking to diversify their portfolios further.

Financial Planning Services

- JP Morgan provides comprehensive financial planning services that include retirement planning, education funding, estate planning, and risk management.

- Their advisors help clients create a financial roadmap to achieve their short-term and long-term financial goals.

- They offer tools and resources to track progress towards financial objectives and make adjustments as needed.

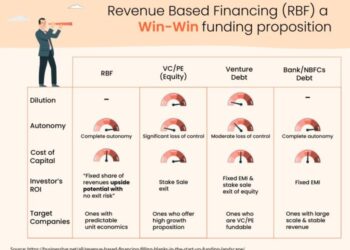

Comparison with Other Financial Firms

- Compared to other financial firms, JP Morgan is known for its personalized approach to investment strategies and financial planning.

- They have a wide range of investment options and resources to help clients navigate the complexities of the financial markets.

- JP Morgan's reputation for excellence in wealth management and financial advisory services sets them apart from other firms in the industry.

Fees and Compensation

When it comes to working with a financial advisor, understanding the fee structure is crucial for clients to make informed decisions. In this section, we will delve into the fee structure for JP Morgan financial advisors, how they are compensated, and how it compares to other financial advisory firms.

Fee Structure for JP Morgan Financial Advisors

- JP Morgan financial advisors typically charge clients a percentage of assets under management (AUM) as their fee. This fee can range from 1% to 2% of the total assets managed by the advisor.

- In addition to the AUM fee, clients may also incur additional costs such as trading fees, account maintenance fees, and other expenses related to specific investment products.

Compensation for JP Morgan Financial Advisors

- JP Morgan financial advisors are compensated based on the fees they charge clients, which are primarily derived from the AUM fee. The more assets they manage for a client, the higher their compensation.

- It's important to note that JP Morgan financial advisors do not earn commissions on trades or transactions, which helps align their interests with those of their clients.

Comparison with Other Financial Advisory Firms

- Compared to other financial advisory firms, JP Morgan's fee structure falls within the industry average for AUM fees, typically ranging from 1% to 2%. However, clients should always compare fee structures and services offered by different firms to ensure they are getting the best value for their money.

- While some firms may charge lower AUM fees, they may compensate for this by charging higher fees on other services or products. It's essential for clients to consider the overall value proposition when evaluating different firms.

Final Thoughts

Wrapping up our discussion on JP Morgan Financial Advisor Review: What Clients Need to Know, this concluding paragraph encapsulates the key points and takeaways from our exploration, leaving readers with a lasting impression.

Q&A

What are the typical qualifications required to become a JP Morgan financial advisor?

Candidates usually need a relevant degree, certifications like CFA or CFP, and prior experience in financial services.

How are JP Morgan financial advisors compensated for their services?

They may receive a combination of fees, commissions, and bonuses based on the assets they manage and the services provided.

What are the common investment strategies recommended by JP Morgan financial advisors?

JP Morgan advisors often focus on diversification, long-term growth, and risk management in their investment recommendations.