Delve into the world of finance with a detailed explanation of Loan Security Meaning for beginners. Explore the crucial role loan security plays for lenders and borrowers, and gain insights into different types of assets used as security.

Uncover the risks associated with various loan security options and learn how they impact loan terms. Discover the differences between secured and unsecured loans, and understand the importance of clear terms in loan security agreements.

Definition of Loan Security

Loan security in finance refers to the assets or property that a borrower pledges to a lender as a guarantee for a loan. This collateral provides the lender with a form of protection in case the borrower defaults on the loan.

Loan security is a crucial aspect of lending as it helps mitigate the risk for the lender and provides assurance to the borrower.

Examples of Common Types of Loan Security

- Real Estate: Properties such as homes, land, or commercial buildings can serve as loan security.

- Automobiles: Vehicles can be used as collateral for auto loans.

- Investments: Stocks, bonds, or other investment portfolios can be pledged as security for loans.

The Importance of Loan Security for Lenders and Borrowers

Loan security is essential for lenders as it reduces the risk of financial loss in case of default by the borrower. It allows lenders to offer loans at lower interest rates since the risk is mitigated. For borrowers, providing loan security can increase their chances of approval for a loan and may result in more favorable loan terms.

Comparison to Collateral and Guarantees

Loan security is similar to collateral in that it provides a form of protection for the lender. However, collateral specifically refers to the asset or property pledged as security, while loan security is a broader term encompassing the concept of protecting the loan through assets.

Guarantees, on the other hand, involve a third party agreeing to repay the loan if the borrower defaults, providing an additional layer of security.

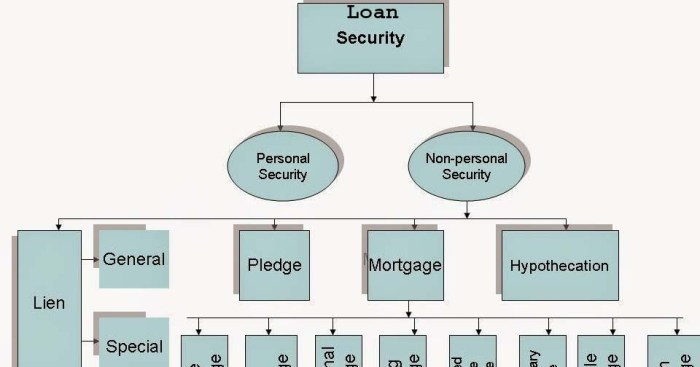

Types of Loan Security

When it comes to securing a loan, different types of assets can be used as collateral to provide lenders with a level of security. The type of loan security chosen can significantly impact the terms of the loan, including the interest rate, loan amount, and repayment period.

It is essential to understand the risks associated with each type of loan security to make an informed decision.

Real Estate

- Real estate, such as a home or commercial property, is a common type of loan security.

- Using real estate as collateral can lead to lower interest rates due to the lower risk for lenders.

- However, there is a risk of foreclosure if the borrower fails to repay the loan, leading to the loss of the property.

- Real estate is preferred as loan security for larger loan amounts, such as mortgages.

Vehicles

- Cars, trucks, or other vehicles can also be used as loan security.

- Lenders may offer lower interest rates for vehicle-secured loans, as the vehicle can be repossessed and sold to recover the loan amount.

- Borrowers risk losing their vehicle if they default on the loan.

- Vehicle loans are suitable for smaller loan amounts, such as auto loans.

Investments

- Investment accounts, stocks, or bonds can serve as loan security.

- Lenders may consider these assets as collateral for loans, but the terms may vary depending on the type and value of the investments.

- There is a risk of losing valuable investments if the borrower fails to repay the loan.

- Using investments as loan security is common for margin loans or securities-based lending.

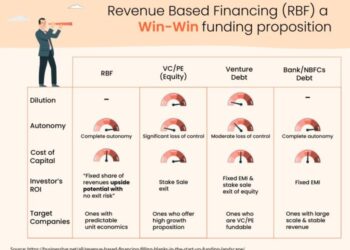

Secured vs. Unsecured Loans

When it comes to loans, one key factor that distinguishes them is the presence or absence of collateral. Secured loans are backed by assets that serve as security, while unsecured loans do not require collateral. Let's delve into the differences between secured and unsecured loans in terms of loan security.

Secured Loans

Secured loans are loans that are backed by collateral, which can be an asset such as a home, car, or savings account. The presence of collateral reduces the risk for the lender, making it easier to secure the loan. Due to this lower risk, secured loans typically come with lower interest rates compared to unsecured loans.

However, if the borrower is unable to repay the loan, the lender has the right to seize the collateral to recoup their losses

Unsecured Loans

On the other hand, unsecured loans do not require any collateral. These loans are granted based on the borrower's creditworthiness and ability to repay the loan. Since there is no collateral involved, unsecured loans pose a higher risk for lenders, resulting in higher interest rates.

The approval process for unsecured loans is also typically more stringent compared to secured loans.

Advantages and Disadvantages

- Secured loans offer lower interest rates due to the presence of collateral, making them more accessible to borrowers with lower credit scores.

- Unsecured loans do not require collateral, which can be advantageous for borrowers who do not have assets to pledge.

- However, the risk of losing collateral is a significant disadvantage of secured loans, while the higher interest rates of unsecured loans can be a drawback for borrowers.

Real-World Examples

- Mortgage loans are a common example of secured loans, where the home serves as collateral for the loan.

- Personal loans and credit cards are examples of unsecured loans, where lenders rely solely on the borrower's creditworthiness for approval.

Loan Security Agreements

When it comes to securing a loan, a loan security agreement plays a crucial role in outlining the terms and conditions that both the borrower and lender must adhere to. Let's delve into the key components, legal implications, importance of clear terms, and negotiation tips for loan security agreements.

Key Components of a Loan Security Agreement

- The description of the collateral being used to secure the loan.

- The obligations and responsibilities of both the borrower and lender.

- Details on default and remedies in case of non-payment.

- Terms and conditions for releasing the security interest upon loan repayment.

Legal Implications of Loan Security Agreements

- Loan security agreements legally bind both parties to fulfill their obligations as Artikeld in the agreement.

- Failure to comply with the terms of the agreement can result in legal action, including seizure of the collateral.

- These agreements provide a sense of security and assurance for lenders, reducing the risk associated with lending money.

Importance of Clear Terms and Conditions

- Clear terms and conditions help avoid misunderstandings and disputes between the borrower and lender.

- They ensure all parties are aware of their rights and obligations, creating a transparent lending process.

- Well-defined terms also provide clarity on the consequences of default, helping both parties understand the potential outcomes.

Tips for Negotiating Favorable Loan Security Agreements

- Conduct thorough research on market rates and terms to negotiate competitive interest rates and favorable terms.

- Seek professional legal advice to understand the implications of the agreement and ensure it aligns with your interests.

- Negotiate for flexibility in repayment terms to accommodate unforeseen circumstances that may affect your ability to repay the loan.

- Review and understand all clauses in the agreement before signing to avoid any surprises in the future.

Final Thoughts

In conclusion, understanding Loan Security Meaning is essential in navigating the complex world of finance. Armed with knowledge about different types of loan security and their implications, beginners can make informed decisions to secure their financial futures.

FAQ Guide

What is the importance of loan security for lenders and borrowers?

Loan security provides a safety net for lenders in case of borrower default and assures borrowers of better loan terms due to reduced risk.

How do different types of assets impact loan terms?

The type of asset used as security can affect interest rates and loan amounts, with more valuable assets often leading to better loan terms.

What are the advantages of secured loans over unsecured loans?

Secured loans typically offer lower interest rates and higher borrowing limits compared to unsecured loans.

What are the key components of a loan security agreement?

A loan security agreement Artikels the collateral provided, repayment terms, default consequences, and other crucial details of the loan.