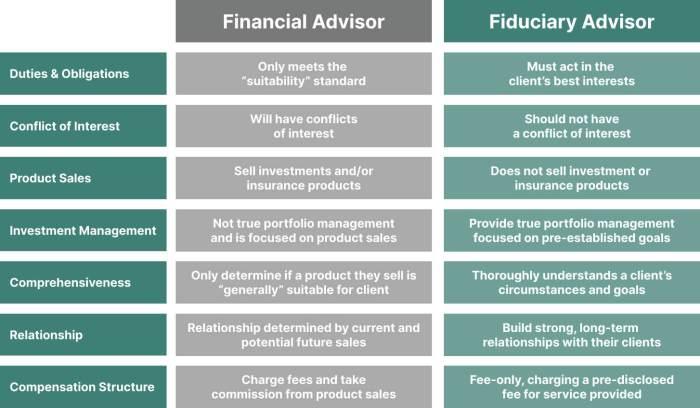

Exploring the variances between a Fiduciary Financial Advisor and a Certified Financial Planner (CFP), this introduction sets the stage for an insightful comparison, offering a glimpse into the distinct roles and responsibilities each professional holds in the realm of financial management.

Providing a comprehensive overview of the differences between these two financial experts, this discussion aims to shed light on how their unique approaches can impact clients' financial well-being.

Fiduciary Financial Advisor vs CFP

Fiduciary Financial Advisor vs CFP: What’s the Difference? This is a common question among those seeking financial guidance. Let's delve into the roles and responsibilities of a fiduciary financial advisor and a Certified Financial Planner (CFP) to understand the distinctions between the two.

Role of a Fiduciary Financial Advisor

A fiduciary financial advisor is legally bound to act in the best interests of their clients. This means they must prioritize their clients' financial well-being above all else. Fiduciary advisors are required to provide advice that is solely in the client's best interest, even if it means recommending a course of action that may not be the most profitable for the advisor.

- Fiduciary advisors must disclose any potential conflicts of interest that may arise.

- They are obligated to recommend investment options that align with the client's goals and risk tolerance.

- They are held to a higher standard of accountability and transparency in their financial recommendations.

Responsibilities of a Certified Financial Planner (CFP)

A Certified Financial Planner (CFP) is a professional who helps individuals and families create comprehensive financial plans to achieve their financial goals. CFPs have expertise in various areas of financial planning, including investments, retirement planning, tax planning, and estate planning.

- CFPs assess a client's financial situation and develop personalized financial plans to meet their objectives.

- They provide guidance on investment strategies, retirement planning, insurance needs, and tax implications.

- CFPs must adhere to a strict code of ethics and professional standards set by the Certified Financial Planner Board of Standards.

Key Differences between Fiduciary Financial Advisor and CFP

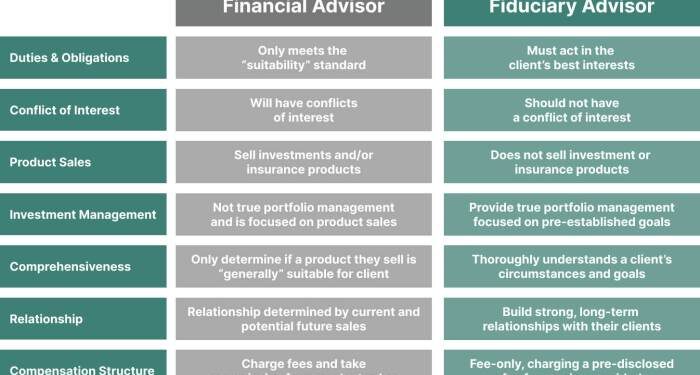

The key difference between a fiduciary financial advisor and a CFP lies in their legal obligations. While fiduciary advisors are required to act in the best interests of their clients at all times, CFPs are not always held to the same fiduciary standard.

CFPs are expected to provide suitable recommendations to clients, but they may not always be required to prioritize the client's best interests above their own.

Scenarios for Suitability

In scenarios where clients prioritize having their best interests protected above all else, a fiduciary financial advisor would be the ideal choice. On the other hand, if clients are looking for comprehensive financial planning services that encompass various aspects of their financial life, a Certified Financial Planner (CFP) may be more suitable due to their expertise in holistic financial planning.

Qualifications and Education

When it comes to the qualifications and education required for fiduciary financial advisors and Certified Financial Planners (CFPs), there are specific paths that individuals must follow to attain these designations.

Qualifications for Fiduciary Financial Advisors

Fiduciary financial advisors are required to act in the best interest of their clients at all times. To become a fiduciary advisor, individuals typically need to hold certain qualifications such as a Certified Financial Planner (CFP) certification, a Chartered Financial Analyst (CFA) designation, or a Certified Public Accountant (CPA) license.

In addition to these certifications, fiduciary advisors must adhere to strict ethical standards and regulatory requirements to maintain their fiduciary status.

Education for Certified Financial Planners (CFPs)

To obtain the CFP certification, individuals must complete a comprehensive educational program that covers key financial planning topics such as retirement planning, investment management, tax planning, and estate planning. Candidates must also hold a bachelor's degree from an accredited institution or have equivalent work experience.

Additionally, CFP candidates must pass a rigorous exam administered by the Certified Financial Planner Board of Standards.

Training and Educational Paths

While fiduciary financial advisors may hold various certifications, the CFP designation is one of the most recognized and respected credentials in the industry. CFPs undergo extensive training in financial planning principles and must adhere to a strict code of ethics and professional conduct.

On the other hand, fiduciary advisors may have different educational backgrounds and certifications, but they all share a commitment to putting their clients' interests first.

Influence on Client Services

The qualifications and education of fiduciary financial advisors and CFPs play a significant role in the services they provide to clients. Clients can trust that both types of advisors have the knowledge, skills, and expertise to help them achieve their financial goals.

Whether it's creating a comprehensive financial plan, managing investments, or navigating complex tax strategies, fiduciary advisors and CFPs are equipped to provide sound financial advice and guidance.

Regulatory Standards and Codes of Ethics

Fiduciary financial advisors and Certified Financial Planners (CFPs) are held to specific regulatory standards and codes of ethics to ensure they act in the best interest of their clients and maintain professionalism in their practice.

Regulatory Standards for Fiduciary Financial Advisors

Fiduciary financial advisors are required to adhere to the fiduciary duty, which means they must always act in the best interest of their clients. This duty requires them to prioritize their clients' needs above their own and disclose any conflicts of interest that may arise.

- Fiduciaries must provide full transparency regarding fees, compensation, and any potential conflicts of interest.

- They must make recommendations that are in the best interest of their clients, based on their financial goals and risk tolerance.

- They are obligated to monitor their clients' investments regularly and make adjustments when necessary.

Codes of Ethics for CFP Professionals

Certified Financial Planners follow a specific code of ethics Artikeld by the CFP Board. This code includes principles such as integrity, objectivity, competence, fairness, confidentiality, professionalism, and diligence.

- CFP professionals must act with integrity and honesty, putting their clients' interests above their own.

- They are required to provide competent and professional financial advice, based on their knowledge and expertise.

- Confidentiality is crucial, as CFPs must protect their clients' information and only disclose it when authorized.

Comparison of Regulatory Standards and Ethical Guidelines

While both fiduciary financial advisors and CFP professionals are committed to acting in their clients' best interest, fiduciaries are legally bound by the fiduciary duty, which sets a higher standard for client care and transparency. CFP professionals, on the other hand, follow a specific code of ethics established by the CFP Board to ensure professionalism and integrity in their practice.

Service Offerings and Client Interactions

When it comes to service offerings and client interactions, fiduciary financial advisors and Certified Financial Planners (CFPs) play crucial roles in helping individuals navigate their financial goals. Let's delve into the specific services offered by each professional and how they interact with clients to understand their unique needs.

Services Offered by Fiduciary Financial Advisors

Fiduciary financial advisors are bound by law to act in the best interest of their clients, ensuring that all recommendations are made with the client's financial well-being in mind. Some typical services offered by fiduciary financial advisors include:

- Creating personalized financial plans tailored to each client's goals and risk tolerance

- Investment management and portfolio diversification

- Retirement planning strategies

- Estate planning and wealth transfer

- Tax planning and optimization

Services Offered by Certified Financial Planners (CFPs)

CFPs are highly trained professionals who offer a wide range of financial planning services to individuals seeking comprehensive advice. Some of the services a CFP can provide include:

- Financial goal setting and prioritization

- Cash flow management and budgeting

- Insurance planning, including life, health, and disability insurance

- Education planning for college savings

- Debt management and reduction strategies

Client Interactions and Customized Financial Plans

Both fiduciary financial advisors and CFPs engage with clients to understand their financial goals, risk tolerance, and overall financial situation. They conduct thorough assessments to create customized financial plans that align with the client's objectives. For example:

A fiduciary financial advisor may work closely with a client nearing retirement to create a comprehensive plan that ensures a steady income stream during retirement while preserving wealth for future generations.

On the other hand, a CFP may assist a young family in setting up a college savings plan for their children, incorporating education funding into their overall financial strategy.

Concluding Remarks

In wrapping up our exploration of Fiduciary Financial Advisor vs CFP: What’s the Difference?, it becomes evident that understanding the nuances between these professionals can greatly benefit individuals seeking financial guidance. By recognizing the specific strengths and specialties of each, clients can make more informed decisions to secure their financial futures.

Essential FAQs

What qualifications are required to become a fiduciary financial advisor?

To become a fiduciary financial advisor, one typically needs to hold relevant certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) and adhere to fiduciary standards.

What are the specific codes of ethics that CFP professionals follow?

CFP professionals adhere to the CFP Board's Code of Ethics and Standards of Conduct, which Artikel principles such as integrity, objectivity, and professionalism in financial planning.

Include more FAQs and answers as needed