As Revenue Based Financing Investors: What They Look for in Startups takes center stage, this opening passage beckons readers with an engaging overview of the topic, setting the stage for an insightful discussion ahead.

It delves into the key aspects of revenue-based financing and sheds light on what investors seek in startups, offering a glimpse into a dynamic funding landscape.

Understanding Revenue-Based Financing Investors

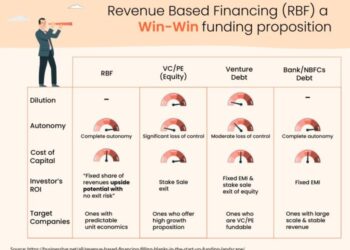

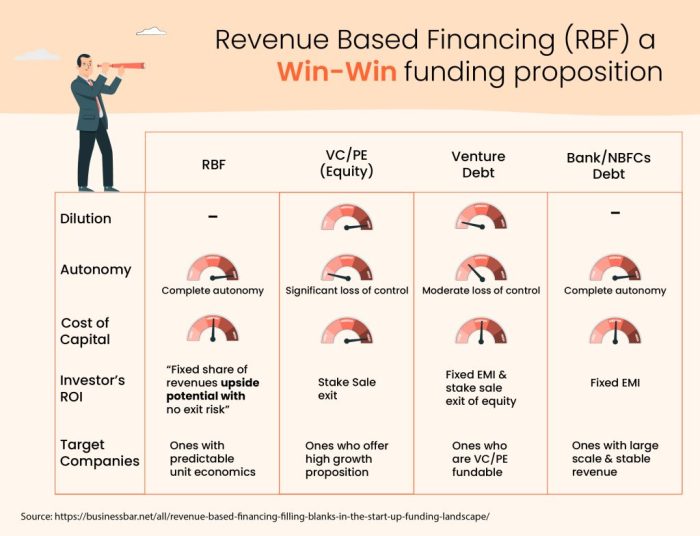

Revenue-based financing is a form of funding where investors provide capital to startups in exchange for a percentage of the company's future revenues. Unlike traditional equity financing, where investors receive ownership stake in the company, revenue-based financing investors receive a share of the company's revenue until a predetermined multiple of the investment amount is repaid.Revenue-based financing investors play a crucial role in providing growth capital to startups without diluting the founders' ownership.

They are focused on the company's revenue-generating potential and seek to support sustainable growth. These investors are interested in startups with a proven track record of generating consistent revenue and are looking to scale their operations.One key difference between revenue-based financing and traditional venture capital is the repayment structure.

While venture capital investors typically receive returns through capital appreciation upon exit, revenue-based financing investors receive repayments based on a percentage of the company's revenue. This model aligns the investors' interests with the company's success and provides an alternative financing option for startups seeking capital without giving up equity.

Criteria for Revenue-Based Financing Investors

Revenue-based financing investors have specific criteria they look for in startups to determine whether they are a good fit for investment. These criteria typically revolve around the startup's revenue growth, profitability, churn rates, revenue model, and predictable cash flow.

Characteristics and Metrics

- Revenue Growth: Investors typically seek startups with a proven track record of consistent revenue growth. This demonstrates the potential for future success and scalability.

- Profitability: Investors look for startups that show a clear path to profitability. A strong business model that can generate profits is attractive to revenue-based financing investors.

- Churn Rates: Low churn rates indicate that customers are satisfied and loyal, which is essential for sustainable revenue growth. Investors prefer startups with low customer churn rates.

Importance of Revenue Model and Predictable Cash Flow

- A Clear Revenue Model: Having a well-defined and understandable revenue model is crucial for revenue-based financing investors. They want to see how the startup generates revenue and how it plans to sustain and grow it over time.

- Predictable Cash Flow: Predictable cash flow is key for investors as it provides assurance that the startup can meet its financial obligations and repay the investment. Startups with predictable cash flow are more likely to attract revenue-based financing.

Due Diligence Process

When revenue-based financing investors consider investing in a startup, they undergo a thorough due diligence process to evaluate the potential risks and returns of the investment. This process involves scrutinizing various aspects of the startup to ensure its viability and growth prospects.

Importance of Financial Statements

Financial statements play a crucial role in the due diligence process for revenue-based financing investors. These documents provide insights into the financial health of the startup, including revenue, expenses, and profit margins. Investors analyze the financial statements to assess the profitability and sustainability of the business.

Significance of Customer Contracts

Customer contracts are another key aspect that revenue-based financing investors consider during due diligence. These contracts provide information about the revenue streams, customer base, and future cash flows of the startup. Investors examine the terms of the contracts to understand the stability and predictability of the revenue generated by the business.

Evaluation of Revenue Projections

Revenue projections are essential for revenue-based financing investors to gauge the growth potential of a startup. Investors assess the accuracy and achievability of the revenue projections to determine the scalability and sustainability of the business. Reliable revenue projections help investors make informed decisions about the investment opportunity.

Investment Terms and Structures

When it comes to revenue-based financing deals, there are specific investment terms and structures that investors typically use. These terms and structures differ from traditional equity investments and are tailored to the unique characteristics of revenue-based financing.

Common Investment Terms and Structures

Revenue-based financing investors often use the following common investment terms and structures:

- Repayment Terms: Unlike traditional loans with fixed monthly payments, revenue-based financing repayment terms are linked to a percentage of the startup's monthly revenue. This means that the amount repaid fluctuates based on the company's performance.

- Revenue Share Agreements: In revenue share agreements, investors receive a set percentage of the startup's monthly revenue until a predetermined amount is repaid, usually with a cap on the total repayment amount. This allows investors to participate directly in the startup's success.

- Exit Events: Revenue-based financing deals may also include provisions for exit events, such as a buyout or IPO, where the investor's repayment may be accelerated or adjusted based on the outcome.

Differences Between Revenue Share Agreements and Traditional Equity Investments

In revenue share agreements, investors receive a percentage of the startup's revenue until a certain amount is repaid, without taking an ownership stake in the company. This differs from traditional equity investments where investors receive shares in the company in exchange for their capital, with the potential for dividends or capital gains based on the company's growth and performance.

Determining Repayment Terms and Revenue Share Percentages

Revenue-based financing investors determine repayment terms and revenue share percentages by assessing the startup's revenue projections, growth potential, and risk factors. Factors such as the startup's historical revenue, industry trends, and market conditions are considered when setting these terms to ensure a fair and mutually beneficial agreement for both parties.

Epilogue

In wrapping up, this discussion encapsulates the essence of what Revenue Based Financing Investors look for in startups, underlining the significance of key metrics and characteristics. It leaves readers with a thought-provoking reflection on the evolving dynamics of startup funding.

FAQ

What metrics do revenue-based financing investors look for in startups?

Revenue growth, profitability, and churn rates are crucial factors that influence investor decisions.

How do revenue-based financing investors evaluate the scalability of a startup's revenue model?

Investors assess the scalability and sustainability of a startup's revenue model through detailed analysis of financial statements, customer contracts, and revenue projections.

What are common investment terms in revenue-based financing deals?

Common terms include revenue share agreements and determining repayment terms and revenue share percentages.