Embark on a journey into the realm of personal finance management with the best free tools at your disposal. Discover how these tools can revolutionize the way you handle your finances and pave the path to financial stability and success.

Overview of Personal Finance Management Tools

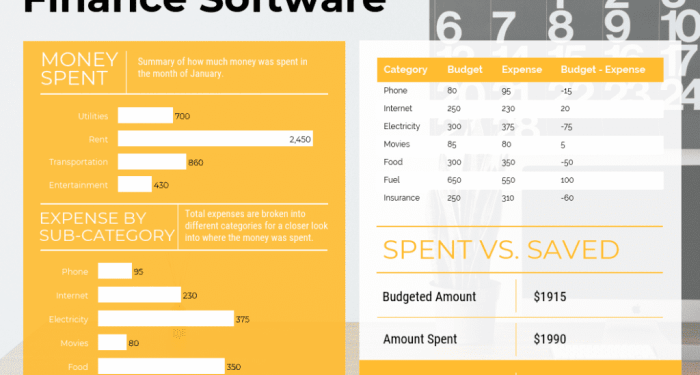

Personal finance management tools are software or applications designed to help individuals track, manage, and optimize their financial activities. These tools offer features such as budgeting, expense tracking, investment analysis, debt management, and financial goal setting.

Using tools to manage personal finances effectively is crucial in achieving financial stability and reaching financial goals. These tools provide insights into spending patterns, help identify areas for saving, and enable better decision-making when it comes to investments and budgeting.

Examples of Popular Free Tools for Managing Personal Finances

- Mint:Mint is a popular free tool that allows users to track their spending, create budgets, and receive alerts for upcoming bills. It also provides credit score monitoring and investment tracking features.

- Personal Capital:Personal Capital offers a free financial dashboard that aggregates all your financial accounts in one place. It also provides tools for retirement planning, investment analysis, and net worth tracking.

- You Need A Budget (YNAB):YNAB is a budgeting tool that focuses on giving every dollar a job. It helps users create a budget based on their income, track expenses, and save for financial goals.

- PocketGuard:PocketGuard is a personal finance app that helps users track their spending, manage bills, and set savings goals. It also offers insights into how much money is available for discretionary spending.

Budgeting Tools

Budgeting is a crucial aspect of personal finance management as it helps individuals track their income, expenses, and savings to achieve financial goals. By creating a budget, individuals can identify areas where they can cut back on spending, allocate funds for savings, and avoid debt.

Key Features to Look for in Budgeting Tools

- Expense Tracking: A good budgeting tool should allow users to categorize and track their expenses easily.

- Income Management: The tool should also enable users to input their income sources and track them accurately.

- Goal Setting: Look for tools that allow you to set financial goals and track your progress towards achieving them.

- Customization: The ability to customize budget categories and set spending limits is essential for personalized budgeting.

- Reports and Analysis: Opt for tools that provide detailed reports and analysis of your spending habits to identify areas for improvement.

Comparison of Free Budgeting Tools

| Tool | Key Features | Platforms |

|---|---|---|

| 1. Mint | Expense tracking, goal setting, credit score monitoring | Web, iOS, Android |

| 2. Personal Capital | Investment tracking, retirement planning, net worth calculation | Web, iOS, Android |

| 3. YNAB (You Need A Budget) | Rule-based budgeting, debt paydown planning, financial education | Web, iOS, Android |

Expense Tracking Applications

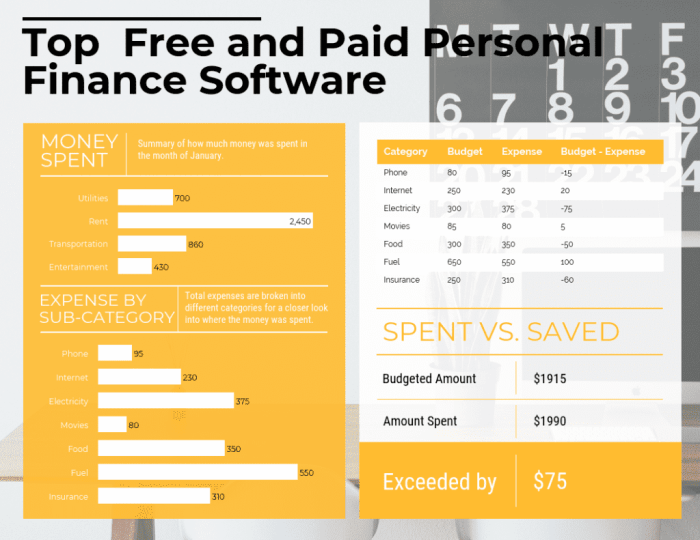

Managing expenses is a crucial aspect of personal finance, and using expense tracking applications can greatly simplify this process.

Benefits of Using Expense Tracking Applications

Expense tracking applications help individuals monitor their spending habits, identify areas where they can cut costs, and stay within their budget. These tools also provide insights into financial trends and patterns, allowing users to make informed decisions about their finances.

List of Free Expense Tracking Tools and Their Functionalities

- Mint:Mint is a popular expense tracking tool that allows users to link their bank accounts, create budgets, and receive personalized money-saving tips.

- Personal Capital:Personal Capital not only tracks expenses but also offers investment management tools and retirement planning calculators.

- Wallet:Wallet is a user-friendly expense tracking app that categorizes expenses, provides insights into spending patterns, and offers bill reminders.

- GoodBudget:GoodBudget uses the envelope system to allocate funds for different spending categories and helps users track their expenses accordingly.

Tips on How to Effectively Track Expenses Using These Tools

- Regularly categorize expenses to get a clear overview of where your money is going.

- Set and monitor budget limits for each spending category to avoid overspending.

- Review your expense reports periodically to identify any unnecessary or excessive costs that can be reduced.

- Take advantage of the features offered by these tools, such as bill reminders and spending trends analysis, to stay on top of your finances.

Investment Management Platforms

Investment management plays a crucial role in personal finance by helping individuals grow their wealth over time through strategic investment decisions. By utilizing investment management platforms, individuals can track their investments, analyze market trends, and make informed decisions to optimize their financial portfolios.

Free Platforms for Managing Investments and Their Features

- Wealthfront: Wealthfront offers automated investment management services, utilizing algorithms to build and manage diversified portfolios based on user preferences and risk tolerance.

- Robinhood: Robinhood is a commission-free trading platform that allows users to invest in stocks, ETFs, options, and cryptocurrencies without paying fees.

- Personal Capital: Personal Capital provides a comprehensive financial dashboard that includes investment tracking, retirement planning tools, and portfolio analysis.

Insights on How to Utilize These Platforms for Better Financial Decisions

- Set clear investment goals and risk tolerance levels before using the platforms to ensure your investment strategy aligns with your financial objectives.

- Regularly monitor your investment performance and adjust your portfolio as needed based on market conditions and your long-term financial goals.

- Take advantage of the educational resources and tools provided by these platforms to enhance your understanding of investing and make informed decisions.

Debt Management Solutions

Dealing with debt is a crucial aspect of personal finance management that can have a significant impact on your financial well-being. By effectively managing and reducing your debts, you can work towards achieving financial stability and security for the future.

Importance of Debt Management

Managing debts is essential to avoid falling into a cycle of high-interest payments and accumulating financial stress. It helps in improving your credit score, reducing financial burden, and ultimately achieving financial freedom.

Free Tools for Debt Management

- Mint: A popular personal finance app that allows you to track your debts, set up payment reminders, and create a customized repayment plan.

- Credit Karma: Provides access to your credit score and offers personalized recommendations for managing and reducing your debts.

- Debt Payoff Planner: Helps you create a debt payoff plan based on the snowball or avalanche method, allowing you to prioritize and pay off debts strategically.

Strategies for Effective Debt Management

- Assess Your Debts: Start by listing all your debts, including outstanding balances, interest rates, and minimum monthly payments.

- Create a Repayment Plan: Use debt management tools to create a structured plan for paying off your debts, focusing on high-interest debts first.

- Budget Wisely: Adjust your budget to allocate more funds towards debt repayment, cutting back on non-essential expenses if needed.

- Consolidate or Refinance: Consider options like debt consolidation or refinancing to streamline your debts and potentially reduce interest rates.

- Stay Committed: Stick to your repayment plan, make timely payments, and avoid taking on new debts to effectively reduce your overall debt burden.

Savings Goal Trackers

Setting and tracking savings goals is a crucial aspect of personal finance management. It helps individuals stay focused, motivated, and disciplined in working towards their financial objectives. By having clear savings goals, individuals can better plan for their future and monitor their progress effectively.

Free Tools for Setting and Tracking Savings Goals

- Mint: Mint is a popular personal finance app that allows users to set savings goals, track their spending, and monitor their progress towards achieving their financial targets.

- YNAB (You Need A Budget): YNAB is a budgeting tool that also helps users set specific savings goals and provides real-time updates on their progress. It emphasizes giving every dollar a job, including saving for future expenses.

- Goals by Stride: This app focuses specifically on goal setting and tracking, including savings goals. Users can create multiple goals, set target dates, and monitor their progress visually through charts and graphs.

Tip: When using savings goal trackers, make sure to set specific, achievable, and realistic goals. Break down larger goals into smaller milestones to stay motivated and celebrate your progress along the way.

Credit Score Monitoring Services

Monitoring your credit score is crucial for maintaining your financial health and ensuring access to better borrowing opportunities. By keeping track of your credit score, you can identify any changes or discrepancies that may impact your overall financial well-being.

Free Credit Score Monitoring Services

- Credit Karma: Offers free credit score monitoring and reporting, along with personalized recommendations for improving your credit health.

- Credit Sesame: Provides free credit score monitoring and financial tips to help you increase your credit score over time.

- Mint: Apart from budgeting tools, Mint also offers free credit score monitoring to help you stay on top of your financial situation.

Best Practices for Improving Credit Scores

- Regularly check your credit report for errors and report any discrepancies to the credit bureaus.

- Pay your bills on time to avoid negative impacts on your credit score.

- Keep your credit utilization ratio low by using only a small portion of your available credit.

- Avoid opening multiple new credit accounts within a short period, as this can lower your average account age and impact your score.

- Monitor your credit score frequently to track your progress and make informed decisions to improve your credit health.

Closure

In conclusion, leveraging the best free tools for managing your personal finances can be a game-changer in achieving your financial goals. Take control of your money, track your expenses, and watch your savings grow with these powerful resources at your fingertips.

FAQs

How important is it to track expenses using free tools?

Tracking expenses using free tools is crucial as it helps you understand where your money is going, identify areas of overspending, and make necessary adjustments to your budget.

Are there any free tools specifically designed for debt management?

Yes, there are free tools tailored to help individuals manage and reduce debt effectively by providing strategies and plans to tackle debt systematically.

Why is it essential to monitor credit scores regularly?

Regularly monitoring credit scores is vital for maintaining financial health as it allows you to track your creditworthiness, detect any errors or fraudulent activities, and take steps to improve your credit score.