Delving into Business Debt Consolidation: Strategies for Small Enterprises to Regain Stability, this introduction immerses readers in a unique and compelling narrative. It provides a comprehensive overview of how small enterprises can tackle debt issues and regain financial stability.

The following paragraphs will delve deeper into various strategies, options, and tips for businesses looking to consolidate their debts and secure a stable financial future.

Introduction to Business Debt Consolidation

Business debt consolidation is a financial strategy that involves combining multiple debts into a single loan or payment, typically with lower interest rates and more manageable terms. For small enterprises, debt consolidation can be crucial in regaining financial stability and avoiding bankruptcy.

Primary Reasons for Small Businesses Needing Debt Consolidation

- Accumulation of High-Interest Debt: Small businesses often rely on loans or credit lines with high-interest rates, leading to a cycle of increasing debt.

- Cash Flow Issues: Inconsistent revenue or unexpected expenses can make it challenging for small businesses to meet their debt obligations on time.

- Multiple Debt Payments: Managing multiple debt payments can be overwhelming for small business owners, leading to missed payments and additional fees.

Common Types of Business Debts That Can Be Consolidated

- Business Credit Card Balances: High-interest rates on business credit cards can accumulate quickly, making it a prime candidate for consolidation.

- Business Loans: Small business loans from different lenders can be consolidated into a single loan with more favorable terms.

- Vendor or Supplier Debts: Unpaid invoices or bills to vendors can be consolidated to streamline payments and avoid penalties.

Strategies for Small Enterprises to Identify Debt Issues

Identifying debt issues is crucial for small businesses looking to regain financial stability. By recognizing and addressing these problems early on, businesses can take proactive steps towards debt consolidation and long-term success.

Conduct a Thorough Debt Assessment

- Before consolidating debt, small enterprises should conduct a comprehensive debt assessment. This involves gathering all financial statements, loan agreements, and credit reports to get a clear picture of the debt situation.

- By understanding the total amount owed, interest rates, and repayment terms, businesses can assess the severity of their debt issues and devise a suitable consolidation plan.

Analyze Cash Flow and Debt-to-Income Ratios

- One effective way to identify debt issues is by analyzing cash flow and debt-to-income ratios. By comparing monthly income to debt obligations, businesses can determine if they are spending more than they earn.

- Monitoring cash flow patterns can help businesses pinpoint areas where expenses can be reduced or revenue can be increased to free up funds for debt repayment.

- Calculating the debt-to-income ratio (DTI) by dividing total monthly debt payments by monthly income can provide insight into the affordability of current debt levels. A DTI above 36% is typically considered high and may indicate a need for debt consolidation.

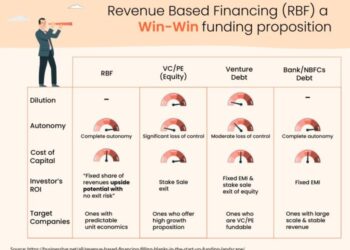

Choosing the Right Debt Consolidation Option

When it comes to choosing the right debt consolidation option for your small business, it is essential to carefully evaluate the available strategies to determine which one aligns best with your financial goals and business needs.

Debt Consolidation Loans

Debt consolidation loans involve taking out a new loan to pay off existing debts, combining them into one monthly payment. Here are some pros and cons to consider:

- Pros:

- May lower interest rates

- Simplified payment structure

- Potential for lower monthly payments

- Cons:

- Requires good credit to qualify

- Additional fees may apply

- Risk of losing collateral if secured

Balance Transfers

Balance transfers involve moving high-interest debt to a new credit card with a lower interest rate. Here are some pros and cons to consider:

- Pros:

- Introductory low or 0% APR offers

- Potential savings on interest payments

- Consolidates debt onto one card

- Cons:

- Transfer fees may apply

- Introductory rates may expire

- Requires good credit to qualify

Debt Management Programs

Debt management programs involve working with a credit counseling agency to create a repayment plan

- Pros:

- Professional guidance and support

- Negotiated lower interest rates

- Consolidates multiple debts into one payment

- Cons:

- May impact credit score

- Monthly fees for administration

- Requires commitment to the program

Implementing Debt Consolidation Strategies

Once small enterprises have identified their debt issues and chosen the right debt consolidation option, it is time to start implementing debt consolidation strategies. This involves creating a realistic budget and repayment plan, negotiating with creditors, and restructuring debt obligations.

Creating a Realistic Budget and Repayment Plan

Before starting the debt consolidation process, small enterprises need to create a realistic budget that Artikels their income, expenses, and debt obligations. This will help them understand how much they can afford to repay each month and where they can make cuts to free up more funds for debt repayment.

A repayment plan should prioritize high-interest debt and ensure regular, timely payments to avoid accruing more interest or penalties.

Negotiating with Creditors and Restructuring Debt Obligations

Small enterprises should proactively communicate with their creditors to negotiate better repayment terms, such as lower interest rates, extended repayment periods, or reduced principal amounts. It is essential to be honest about financial difficulties and demonstrate a commitment to repaying the debt.

Additionally, restructuring debt obligations may involve consolidating multiple debts into a single loan with better terms or seeking professional help from debt consolidation companies.

Monitoring and Maintaining Financial Stability

After implementing debt consolidation strategies, it is crucial for small enterprises to monitor their financial progress to ensure stability and prevent future debt issues.

Significance of Monitoring Financial Progress

- Regularly tracking income, expenses, and cash flow post-debt consolidation helps in identifying any financial discrepancies or potential issues.

- Monitoring financial progress allows businesses to make informed decisions and adjustments to their financial strategies if needed.

- It provides insights into the effectiveness of the debt consolidation plan and helps in evaluating the overall financial health of the enterprise.

Strategies for Maintaining Financial Stability

- Establish a budget and stick to it to ensure expenses are in line with income and to avoid overspending.

- Focus on increasing revenue streams through diversification or new business opportunities to strengthen financial stability.

- Regularly review and update financial goals and objectives to stay on track and adapt to changing market conditions.

Building an Emergency Fund and Sound Financial Practices

- Set aside a portion of profits to build an emergency fund that can cover unexpected expenses or financial setbacks without resorting to additional debt.

- Implement sound financial practices such as timely payment of bills, avoiding unnecessary expenses, and saving for future investments to prevent relapse into debt.

- Seek professional financial advice or guidance to ensure that the business is following best practices and maintaining financial stability in the long run.

Outcome Summary

In conclusion, Business Debt Consolidation: Strategies for Small Enterprises to Regain Stability offers a roadmap for businesses to navigate the complex terrain of debt consolidation. By implementing these strategies, businesses can pave the way for a more stable and prosperous future.

Common Queries

What are the primary reasons why small businesses may need debt consolidation?

Small businesses may need debt consolidation to streamline multiple debts into one manageable payment, reduce interest rates, and improve cash flow.

How can small enterprises identify their debt issues?

Small enterprises can identify their debt issues by analyzing cash flow, debt-to-income ratios, and conducting a thorough debt assessment.

What are the common types of business debts that can be consolidated?

Common types of business debts that can be consolidated include credit card debt, business loans, and vendor debts.

Why is it important to monitor financial progress post-debt consolidation?

Monitoring financial progress post-debt consolidation is crucial to ensure that the business stays on track towards financial stability and to identify any potential issues early on.

How can small enterprises negotiate with creditors during the debt consolidation process?

Small enterprises can negotiate with creditors by outlining a repayment plan, demonstrating financial hardship, and seeking reduced interest rates or extended payment terms.