Embark on the journey of discovering How to Find a Trusted Financial Advisor Near You (Global Guide) with an intriguing opening that hooks the readers in, setting the stage for informative insights to follow.

Delve into the details in the next paragraph to provide a comprehensive overview of the topic.

Understanding the Role of a Financial Advisor

Financial advisors play a crucial role in helping individuals manage their personal finances effectively. They provide valuable guidance and expertise to help clients make informed decisions regarding their money matters.

Importance of Seeking Advice from a Financial Advisor

Financial advisors offer personalized advice based on an individual's financial goals, risk tolerance, and time horizon. They can help clients create a comprehensive financial plan, navigate complex investment options, and optimize their overall financial situation.

- Assessment of Financial Goals: Financial advisors work with clients to identify their short-term and long-term financial objectives.

- Risk Management: They help clients assess and manage risks associated with investments to align with their risk tolerance.

- Investment Planning: Financial advisors develop investment strategies tailored to clients' goals and timeframes.

- Estate Planning: They assist clients in creating an estate plan to ensure the efficient transfer of assets to beneficiaries.

Services Offered by Financial Advisors

Financial advisors offer a range of services to help clients achieve their financial goals and secure their financial future. These services may include investment management, retirement planning, tax planning, insurance planning, and more.

Financial advisors act as a trusted partner in guiding individuals towards financial success and security.

Qualities to Look for in a Financial Advisor

When searching for a financial advisor, it is essential to consider certain qualities that make them trustworthy and reliable. These qualities can help you make an informed decision and ensure that your financial future is in good hands.

Professionalism and Ethics

Financial advisors should uphold high ethical standards and act in the best interest of their clients. Look for advisors who are transparent, honest, and prioritize your financial goals over their own interests.

Competence and Expertise

A trustworthy financial advisor should have the necessary knowledge and skills to provide sound financial advice. They should be well-educated, experienced, and continuously update their expertise to stay current with industry trends and regulations.

Good Communication Skills

Effective communication is key when working with a financial advisor. They should be able to explain complex financial concepts in a clear and understandable manner, listen attentively to your concerns, and maintain open lines of communication throughout your financial journey.

Client-Centered Approach

A reliable financial advisor will tailor their advice and recommendations to your specific financial situation, goals, and risk tolerance. They should take the time to understand your needs and develop a personalized financial plan that aligns with your objectives.

Professional Certifications

Financial advisors may hold different certifications that demonstrate their expertise and commitment to professional development. Common certifications include Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), and Certified Public Accountant (CPA). These certifications indicate that the advisor has met rigorous standards of education, experience, and ethics.

Experience

Experience plays a crucial role in the selection of a financial advisor. Advisors with a proven track record of successfully helping clients navigate various financial situations and market conditions are likely better equipped to provide valuable insights and guidance. Look for advisors with a solid history of managing investments, creating financial plans, and achieving positive outcomes for their clients.

Researching Financial Advisors in Your Area

When it comes to finding a trusted financial advisor near you, conducting thorough research is crucial to ensure you make the right choice. Here are some tips on how to research financial advisors in your area effectively:

Reading Reviews and Testimonials

- Look for online reviews and testimonials from previous clients to get an idea of the advisor's reputation and track record.

- Pay attention to both positive and negative feedback to understand the strengths and weaknesses of the advisor.

- Consider reaching out to friends or family members for personal recommendations based on their experiences.

Checking Background and Credentials

- Verify the financial advisor's credentials, such as certifications, licenses, and affiliations with reputable organizations.

- Research the advisor's background to ensure they have a clean disciplinary record and no history of malpractice or unethical behavior.

- Confirm that the advisor has experience working with clients in similar financial situations to yours.

Meeting with Potential Financial Advisors

When meeting with potential financial advisors, it is crucial to ask key questions to ensure you find the right fit for your financial needs. Assessing a financial advisor's communication style and responsiveness can give you insight into how they will work with you in the future.

Establishing trust and feeling comfortable during the initial meeting is essential for a successful long-term relationship.

Key Questions to Ask

- What is your experience in financial planning?

- How do you charge for your services?

- Can you provide references from current clients?

- What is your investment philosophy?

Assessing Communication Style and Responsiveness

During the meeting, pay attention to how the financial advisor communicates complex financial concepts to ensure you can understand them easily. Assess their responsiveness by observing how quickly they respond to your inquiries and how proactive they are in addressing your concerns.

Importance of Feeling Comfortable and Establishing Trust

Feeling comfortable with your financial advisor is essential as you will be sharing personal financial information and goals with them. Trust is the foundation of a successful financial advisor-client relationship, so it is crucial to establish trust from the initial meeting to ensure a positive and productive partnership.

Evaluating Fee Structures and Services Offered

When choosing a financial advisor, it is crucial to evaluate the fee structures and services they offer to ensure they align with your financial goals and needs.

Fee Structures Used by Financial Advisors

- Percentage of Assets Under Management (AUM): This fee structure involves charging a percentage of the total assets managed by the advisor. For example, a financial advisor may charge 1% of the total assets under management annually.

- Hourly Rate: Some financial advisors charge an hourly rate for their services. This can be beneficial if you only need occasional advice or assistance with specific financial matters.

- Flat Fee: Financial advisors may also charge a flat fee for a specific service or financial plan. This fee remains the same regardless of the assets under management.

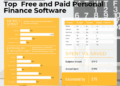

Services Offered by Financial Advisors

- Financial Planning: This includes creating a comprehensive financial plan tailored to your goals, income, expenses, and risk tolerance.

- Investment Management: Financial advisors can help you manage your investment portfolio, choose suitable investments, and monitor performance.

- Tax Planning: Advisors can assist in optimizing your tax strategy to minimize tax liabilities and maximize savings.

- Retirement Planning: They can help you plan for a comfortable retirement by setting savings goals, estimating retirement expenses, and creating a retirement income plan.

Evaluating Fee Structures Alignment with Financial Needs

It's essential to assess whether a financial advisor's fee structure aligns with your financial needs and goals. Consider factors such as the complexity of your financial situation, the level of service required, and the potential returns on investments. Make sure to discuss the fee structure openly with the advisor and ask for clarification on any fees or charges to ensure transparency and avoid any surprises down the road.

Verifying a Financial Advisor’s Credibility

When selecting a financial advisor, it is crucial to verify their credibility to ensure they are qualified and reliable to handle your finances effectively.

Checking Credentials and Licenses

- Verify the financial advisor's credentials by checking if they hold relevant certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

- Confirm if the financial advisor is registered with regulatory bodies like the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA).

Reviewing Disciplinary History

- Look into any disciplinary history or complaints filed against the financial advisor by checking with regulatory organizations or online databases.

- Consider the nature of the complaints and the severity of any disciplinary actions taken to gauge the advisor's ethical conduct.

Ensuring Fiduciary Standards

- Ask the financial advisor if they operate under a fiduciary standard, which means they are obligated to act in your best interests at all times.

- Request a signed fiduciary oath or agreement from the advisor to ensure they prioritize your financial well-being over their own interests.

Building a Long-Term Relationship with Your Financial Advisor

Building a long-term relationship with your financial advisor is crucial for achieving your financial goals. It involves effective communication, regular check-ins, and trust-building. Here are some tips to help you maintain a healthy and productive relationship with your financial advisor.

Benefits of Regular Check-ins and Reviews

Regular meetings with your financial advisor provide an opportunity to review your financial situation, track progress towards your goals, and make any necessary adjustments. These check-ins help ensure that your financial plan remains aligned with your objectives and current circumstances.

- Discuss any changes in your life that may impact your finances, such as a new job, marriage, or children.

- Review your investment portfolio performance and make adjustments based on market conditions.

- Evaluate your progress towards long-term financial goals and make any necessary changes to stay on track.

Effective Communication of Financial Goals and Concerns

Clear communication is key to a successful relationship with your financial advisor. When discussing your financial goals and concerns, be honest, transparent, and specific. This will help your advisor tailor their advice and recommendations to best suit your needs.

- Clearly articulate your short-term and long-term financial goals, whether it's saving for retirement, buying a home, or funding your child's education.

- Express any concerns or fears you may have about your financial situation, such as market volatility or economic uncertainty.

- Ask questions and seek clarification on any financial matters that you do not fully understand.

Concluding Remarks

Concluding with a captivating summary that encapsulates the essence of the discussion in a compelling manner.

FAQ

What qualifications should I look for in a financial advisor?

Look for certifications like CFP, experience in the field, and a good reputation for trustworthiness.

How can I verify a financial advisor's credibility?

Check their licenses, credentials, any disciplinary history, and ensure they follow fiduciary standards.

What are common services offered by financial advisors?

Services can include financial planning, investment advice, retirement planning, and estate planning.

Why is it important to establish trust with your financial advisor?

Establishing trust ensures open communication, better understanding of your financial goals, and a long-term successful partnership.