JEPI Stock vs SCHD: Which Dividend ETF Performs Better? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve into the comparison of JEPI Stock and SCHD ETFs, we uncover intriguing insights into their performance metrics, composition, and management styles that shape their dividend yields and overall returns.

Introduction to JEPI Stock and SCHD ETFs

JEPI Stock and SCHD ETF are both investment options that focus on dividends, but they have key differences in their structure and approach. JEPI Stock represents ownership in a single company, while SCHD ETF is a collection of dividend-paying stocks managed by professionals.

Dividends are regular payments made by companies to shareholders as a portion of their profits, providing a steady income stream for investors.

Differences between JEPI Stock and SCHD ETF

- JEPI Stock is a single stock representing ownership in one company, while SCHD ETF is a diversified collection of dividend-paying stocks from various companies.

- JEPI Stock carries individual company risk, where the stock price can fluctuate based on the performance of that specific company. In contrast, SCHD ETF spreads risk across multiple companies, reducing the impact of individual stock performance.

- SCHD ETF typically has lower expense ratios compared to actively managed mutual funds, making it a cost-effective way to gain exposure to dividend-paying stocks.

Importance of Dividends in Investment Portfolios

- Dividends provide a source of passive income for investors, especially those looking for regular cash flow.

- Companies that pay consistent dividends often demonstrate financial stability and strength, making them attractive investments.

- Reinvesting dividends can compound returns over time, leading to significant growth in investment portfolios.

Performance Metrics Comparison

When comparing the performance of JEPI Stock and SCHD ETFs, it is crucial to analyze various key metrics to determine which investment option may be more suitable for investors.

Historical Performance

Historical performance data provides valuable insights into how JEPI Stock and SCHD ETFs have fared over time. JEPI stock may have shown higher volatility compared to the relatively stable performance of SCHD ETF. It is essential for investors to assess their risk tolerance and investment goals before making a decision.

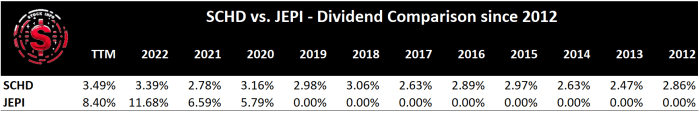

Dividend Yield Trends

Analyzing the dividend yield trends of JEPI and SCHD can help investors understand the income potential of each investment. SCHD, known for its focus on high-quality, dividend-paying stocks, may offer a more consistent dividend yield compared to JEPI stock, which might have fluctuating dividend payouts.

Volatility and Risk

Volatility and risk are important factors to consider when investing in JEPI versus SCHD. JEPI stock may be riskier due to its potential for higher volatility, while SCHD ETF, with its diversified portfolio of dividend-paying stocks, could offer a more stable investment option.

Investors should carefully evaluate their risk tolerance and investment horizon before choosing between the two options.

Composition and Holdings

When analyzing the performance of JEPI Stock and SCHD ETF, it is crucial to understand the composition and holdings of each investment vehicle. Let's delve into the details of their composition and holdings to see how they impact their overall performance.

JEPI Stock Composition

JEPI Stock is composed of a diverse range of industries, sectors, and geographic regions. The stock is designed to provide exposure to a broad spectrum of companies, aiming for a well-rounded portfolio. The composition of JEPI Stock includes sectors such as technology, healthcare, consumer goods, financials, and more.

Additionally, the stock may have exposure to various geographic regions, both domestic and international, further diversifying its holdings.

Top Holdings in SCHD ETF

The SCHD ETF, on the other hand, focuses on high dividend yield companies with a history of consistent dividend payments. Some of the top holdings within the SCHD ETF include well-known companies such as Microsoft, Johnson & Johnson, Procter & Gamble, and PepsiCo.

These companies are known for their strong financial performance and dividend payouts. The weightage of each holding within the SCHD ETF is determined by the company's market capitalization and dividend yield, among other factors.

Impact of Composition on Performance

The composition of JEPI Stock and SCHD ETF plays a significant role in determining their performance. JEPI Stock's diversified composition across various industries and regions can help mitigate risks associated with specific sectors or geographies. On the other hand, SCHD ETF's focus on high dividend yield companies may provide stability and consistent income for investors, especially during market downturns.

Understanding how the composition of each investment vehicle influences their performance is essential for investors looking to make informed decisions.

Management and Expense Ratios

When considering investing in ETFs, it is crucial to understand the management style and expense ratios associated with each fund. Let's delve into how JEPI Stock and SCHD ETFs are managed and compare their expense ratios.

Management Style

JEPI Stock follows an active management style, meaning that the fund's managers regularly buy and sell securities in an attempt to outperform the market. On the other hand, SCHD ETF follows a passive management style, aiming to replicate the performance of a specific index, in this case, the Dow Jones U.S.

Dividend 100 Index.

Expense Ratios Comparison

- JEPI Stock has an expense ratio of 0.50%, which means that for every $1,000 invested, $5 goes towards covering the fund's operating expenses.

- SCHD ETF, on the other hand, has a lower expense ratio of 0.06%, making it a more cost-effective option for investors.

Impact of Management Fees and Expenses on Returns

Management fees and expenses can significantly impact the overall returns of an ETF. Higher expense ratios like that of JEPI Stock can eat into your investment returns over time, especially when compared to a lower-cost option like SCHD. It's essential to consider these fees when choosing between different ETFs, as they can affect the long-term performance of your investment portfolio.

Final Summary

In conclusion, the comparison between JEPI Stock and SCHD ETFs sheds light on the nuances of dividend investing, highlighting the importance of understanding performance metrics, composition, and management styles to make informed investment decisions.

FAQ Overview

What are the key differences between individual stocks like JEPI and ETFs like SCHD?

Individual stocks represent ownership in a single company, while ETFs are diversified investment funds that hold multiple assets, providing investors with broader exposure to the market.

How do management fees and expenses impact the overall returns of JEPI Stock and SCHD ETFs?

Higher management fees and expenses can eat into the total returns of an investment, reducing the net gains for investors. It's important to consider these costs when evaluating the performance of JEPI Stock and SCHD ETFs.

What is the significance of dividends in investment portfolios?

Dividends play a crucial role in generating passive income for investors, providing a steady stream of cash flow that can enhance overall returns and act as a source of stability during market fluctuations.