Starting off with MX Money Management: Is It the Smartest Tool in 2025?, this opening paragraph aims to grab the readers' attention and provide a compelling overview of the topic.

The following paragraph will delve into the specifics and details of MX Money Management in 2025.

Overview of MX Money Management in 2025

MX Money Management is a financial tool that helps individuals and businesses track, manage, and optimize their finances. By leveraging technology, MX Money Management provides users with a comprehensive view of their financial health, including budgeting, expense tracking, investment management, and more.

Evolution of MX Money Management

By 2025, MX Money Management has evolved significantly from its early days. The integration of artificial intelligence and machine learning has enabled more personalized and proactive financial insights for users. Real-time data analysis and predictive analytics have also become standard features, allowing for better decision-making and financial planning.

Importance of MX Money Management Tools

MX Money Management tools play a crucial role in the financial landscape by promoting financial literacy, improving financial wellness, and enhancing overall financial stability. These tools empower users to make informed financial decisions, set and achieve financial goals, and ultimately build a secure financial future.

Advantages of Using MX Money Management

MX Money Management tools offer various benefits that can significantly impact individuals and businesses.

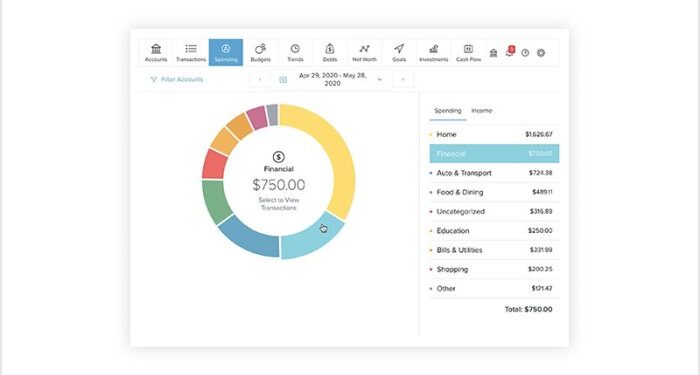

Efficient Budgeting and Expense Tracking

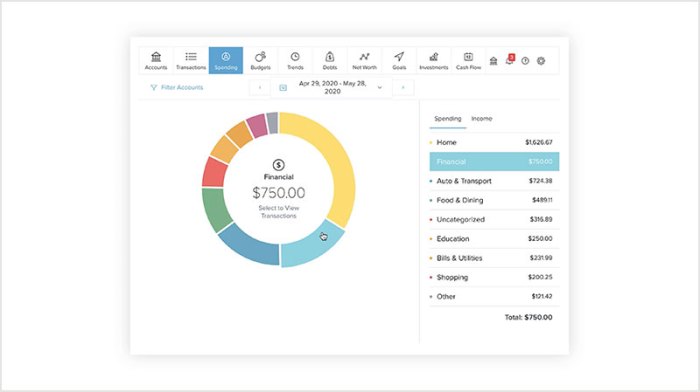

- MX Money Management tools provide a centralized platform to track income and expenses, making it easier to create and stick to a budget.

- By categorizing transactions and providing detailed reports, users can identify areas where they can cut costs and save money.

Improved Financial Decision-Making

- With real-time updates on financial data, users can make informed decisions regarding investments, savings, and debt management.

- By analyzing trends and patterns in spending, individuals and businesses can adjust their financial strategies for better outcomes.

Enhanced Security and Fraud Protection

- MX Money Management tools offer secure encryption and monitoring features to protect sensitive financial information.

- By detecting unusual activities and unauthorized transactions, users can prevent fraud and safeguard their assets.

MX Money Management Tools and Technologies

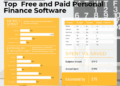

In 2025, there are various MX Money Management tools available that offer advanced features to help individuals and businesses manage their finances efficiently.

Popular MX Money Management Tools

- 1. Mint: Mint is a popular budgeting tool that allows users to track their expenses, create budgets, and set financial goals. It also provides personalized money-saving tips.

- 2. Personal Capital: Personal Capital offers investment tracking, retirement planning, and wealth management services. It provides a comprehensive view of your financial health.

- 3. YNAB (You Need A Budget): YNAB is a budgeting tool that focuses on helping users give every dollar a job. It emphasizes zero-based budgeting and financial accountability.

Features of Advanced MX Money Management Technologies

Advanced MX Money Management technologies in 2025 offer real-time synchronization of financial accounts, enhanced security features, AI-driven insights, and customizable reports.

Comparison of MX Money Management Platforms

| Platform | Features |

|---|---|

| Mint | Expense tracking, budget creation, goal setting, money-saving tips |

| Personal Capital | Investment tracking, retirement planning, wealth management, financial health overview |

| YNAB | Zero-based budgeting, financial accountability, goal-oriented budgeting |

Challenges and Risks Associated with MX Money Management

As beneficial as MX Money Management tools can be, there are also challenges and risks that users need to be aware of to ensure the security and effectiveness of their financial management

Potential Pitfalls of Relying Heavily on MX Money Management Tools

While MX Money Management tools can streamline financial tasks and provide valuable insights, relying too heavily on these tools can lead to a sense of complacency and detachment from one's financial situation. Users may become overly dependent on the tools, neglecting to critically assess their financial decisions or understand the underlying principles.

Cybersecurity Risks Related to MX Money Management Platforms

One of the major risks associated with MX Money Management platforms is the threat of cybersecurity breaches. With sensitive financial data stored and transmitted through these platforms, there is a potential for hackers to gain unauthorized access to personal information, leading to identity theft, fraud, or other malicious activities.

It is crucial for users to ensure that MX Money Management platforms have robust security measures in place, such as encryption, multi-factor authentication, and regular security updates, to mitigate the risk of cyber attacks.

Strategies to Mitigate Risks When Using MX Money Management Services

To mitigate the risks associated with using MX Money Management services, users can take proactive steps to enhance their security practices. This includes regularly updating passwords, monitoring account activity for any suspicious transactions, and being cautious when sharing personal information online.

Additionally, users should educate themselves on common cybersecurity threats and best practices to safeguard their financial data when using MX Money Management platforms.

Future Trends in MX Money Management

The future of MX Money Management is set to be shaped by rapid advancements in technology, particularly the integration of artificial intelligence and machine learning. These innovations are expected to revolutionize the way financial decisions are made and managed, leading to more efficient and personalized solutions for users.

Impact of Artificial Intelligence and Machine Learning

Artificial intelligence and machine learning algorithms are projected to play a crucial role in enhancing the capabilities of MX Money Management tools. By analyzing vast amounts of data at high speeds, these technologies can provide more accurate predictions and insights into financial trends.

This will enable users to make informed decisions based on real-time data, ultimately improving their financial outcomes.

- AI-powered algorithms can help in creating personalized investment portfolios based on individual risk profiles and goals.

- Machine learning can analyze spending patterns to identify areas where users can save money or optimize their budgets.

- Predictive analytics can forecast market trends and recommend the best investment opportunities for users.

Potential Innovations in MX Money Management for 2030 and Beyond

Looking ahead, the future of MX Money Management is likely to witness the emergence of innovative features and tools that further enhance user experience and financial outcomes. Some potential innovations include:

- Integration of virtual financial advisors powered by AI to provide personalized recommendations and guidance.

- Enhanced security measures through biometric authentication and blockchain technology to protect user data and transactions.

- Greater automation in managing finances, from bill payments to investment decisions, to save users time and effort.

Final Review

Concluding with a captivating summary of the discussion, this paragraph wraps up the key points in an engaging manner.

Query Resolution

What are the potential pitfalls of relying heavily on MX Money Management tools?

Answer: Some potential pitfalls include over-reliance on automated decisions and lack of human oversight. It's crucial to use these tools as aids rather than replacements for sound financial judgment.

How can one mitigate cybersecurity risks related to MX Money Management platforms?

Answer: Mitigating cybersecurity risks involves using strong, unique passwords, enabling two-factor authentication, and staying vigilant against phishing attempts. Regularly updating software and being cautious with sharing personal information are also key.

What future trends can we expect in MX Money Management tools?

Answer: Future trends may include increased integration of AI and machine learning for more personalized financial insights, as well as enhanced security measures to combat evolving cyber threats.